Bill.com is a cloud-based operation that aims to help small and mid-sized businesses make better use of their time. It allows companies to create and pay bills, send invoices and get paid using automated processes that can streamline back-office operations. With its smart AP and AR software tools, Bill.com uses technology to take a lot of the drudgery out of the payments process, while also combining all of your payment accounts and accounting tools into one place.

- Want to try Bill.com? Check out the website here

While the cloud software can be fully exploited by businesses Bill.com is also used by professional accountants, with over 80% of the top US accounting firms now said to be making use of its services. Indeed, Bill.com claims that it helps move in excess of $100B annually, helping millions of businesses get paid.

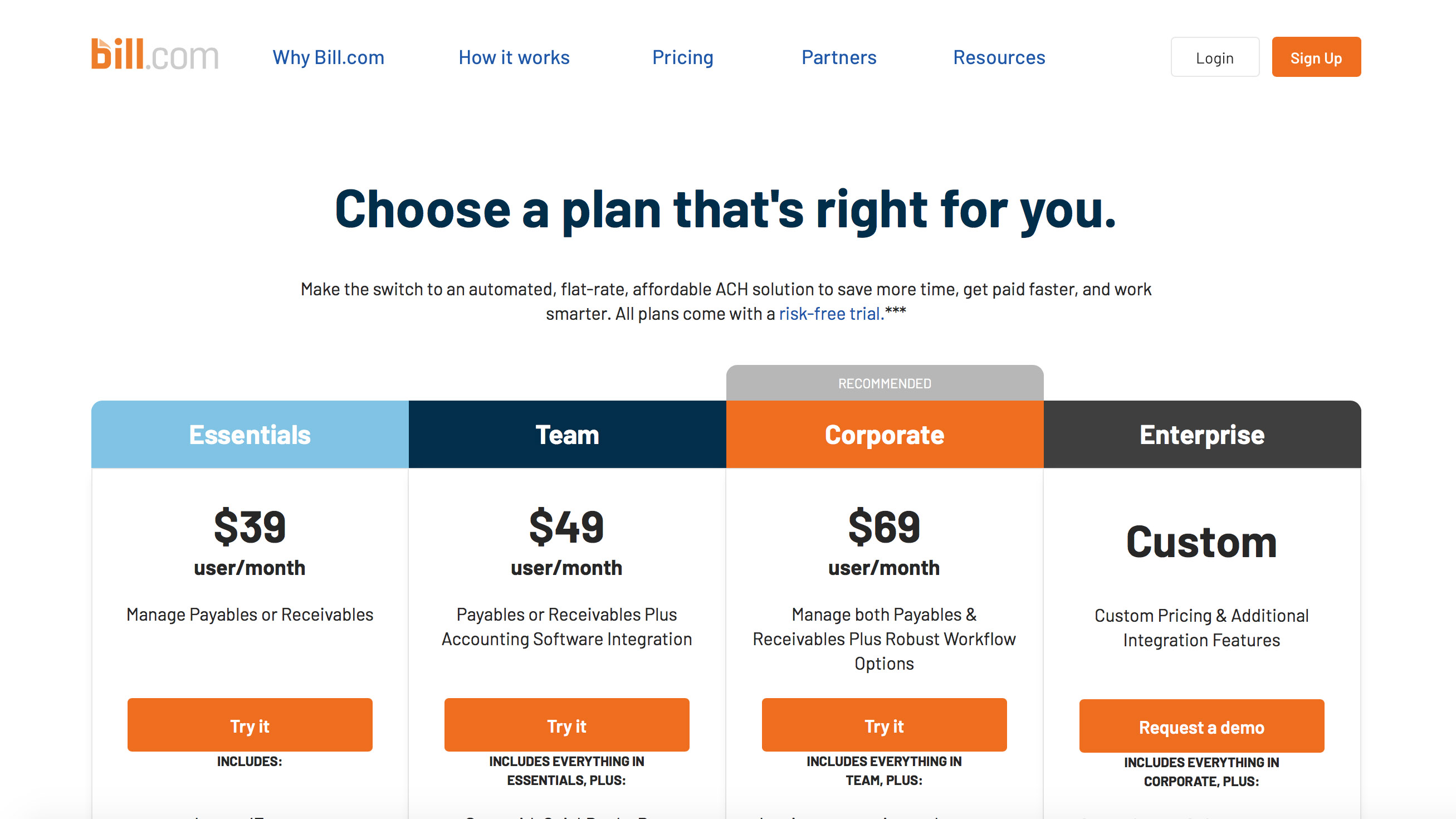

Pricing

The Bill.com pricing structure is basically divided into two different areas, with one being aimed at businesses while the other targets accounting firms. Starting off with the business side of things there is the Essentials package, which costs from $39 per user, per month, which allows you to manage payables or receivables.

Next, there’s Team, which costs from $49 per user, per month, which lets you process payables or receivables plus it features accounting software integration. Following that is Bill.com’s recommended selection, the Corporate package, which starts at $69 per user, per month. This allows for managing payables and receivables while also offering robust workflow options.

Rounding it out is a Custom edition, which is a more bespoke package. Note that as you step up through the package grades you get everything in the lower tier edition, plus more features on top of that, which we’ll outline in the next section. Meanwhile, the partner program offered to accountancy professionals by Bill.com starts from $49 per month.

All packages come with the option of a free trial too, although it's worth noting that there are additional costs for various transaction services such as ePayment/ACH processing fees, wire transfers and credit card payments. These are detailed on the Bill.com pricing page too.

Features

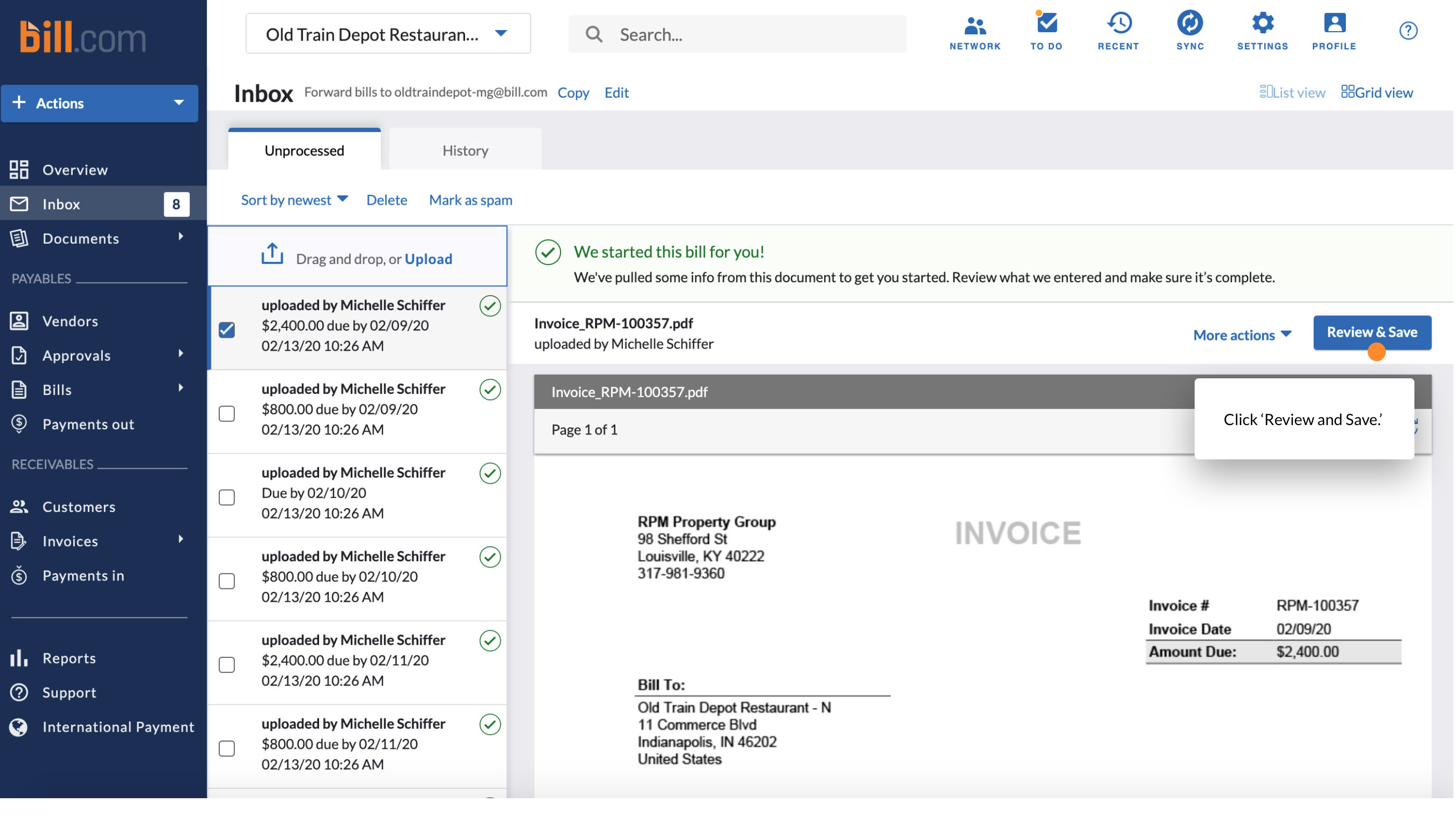

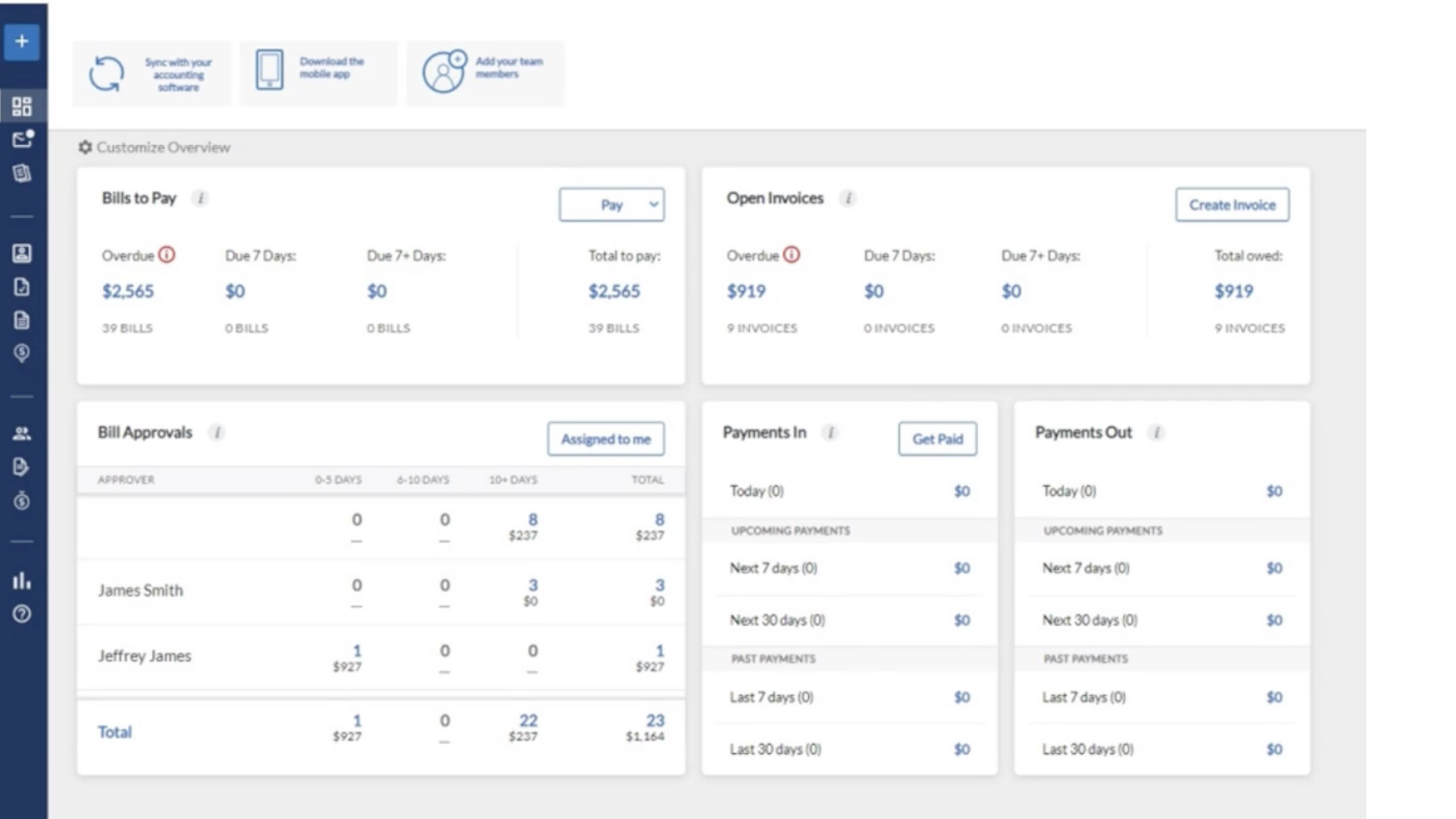

The core feature set of Bill.com consists of accounts payable whereby you can approve, pay and sync bill payments along with accounts receivable, which lets you send invoices and speed up getting money owed to your business.

On top of that, there are ACH payments, international payments and software integration, which combined together should help your business improve its efficiency and save time. It’s possible to let your team set up approval workflows and custom roles while it’s also easy to sync transactions with your accounting software and other payment tools.

Performance

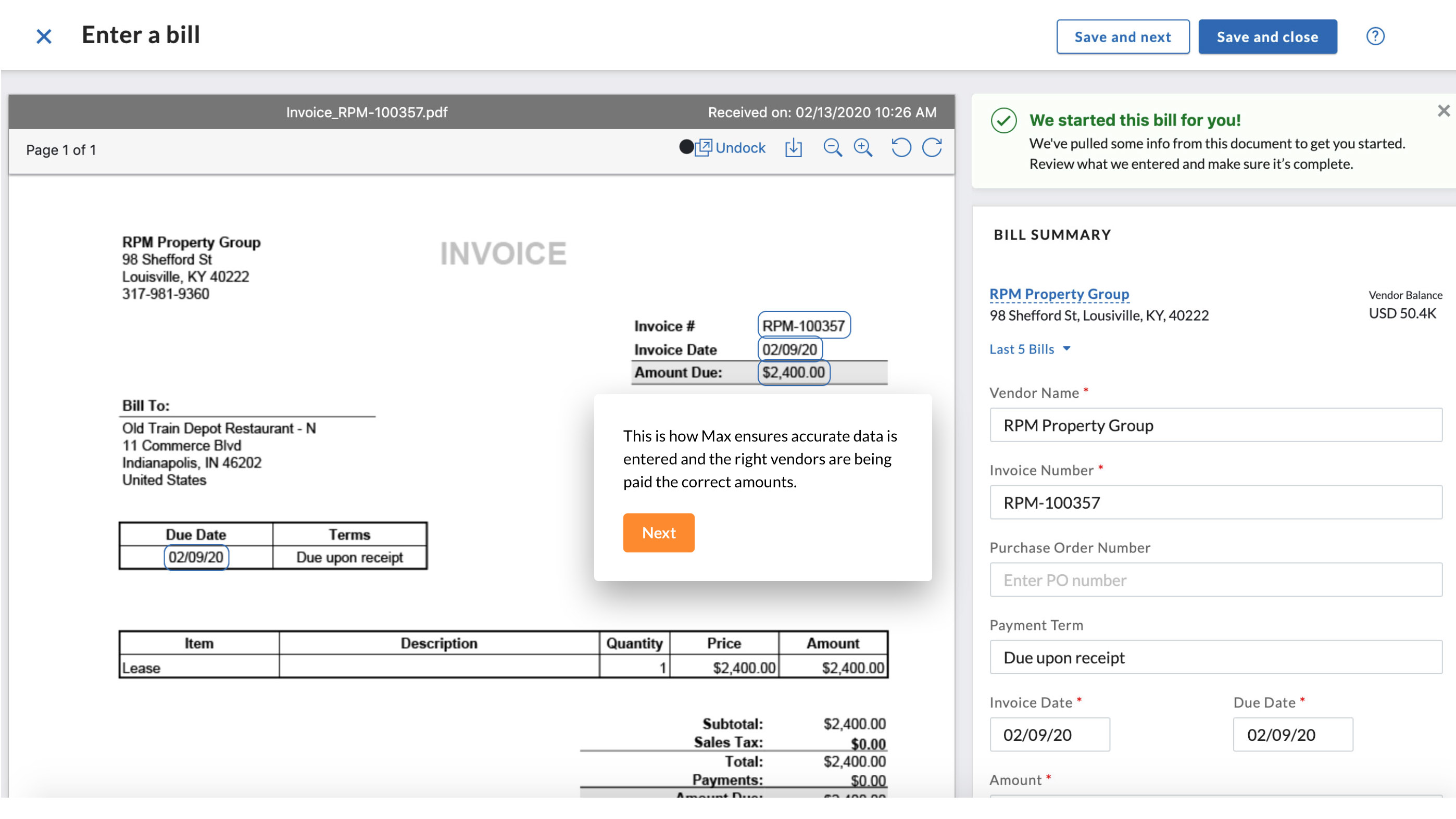

Thanks to the way that Bill.com has been engineered, and because it works in the cloud, the payment process is quick and simple, once it has been configured. You can be set up and running in a short space of time and Bill.com encrypts its data using Transport Layer Security or TLS.

You’ll be able to enjoy sprightly performance once you’re logged into the Bill.com customer location as the dashboard and it’s related areas all work fast and efficiently, thanks to their cloud-based design. Similarly impressive are the tools for syncing with other applications, such as your accounting software.

Ease of use

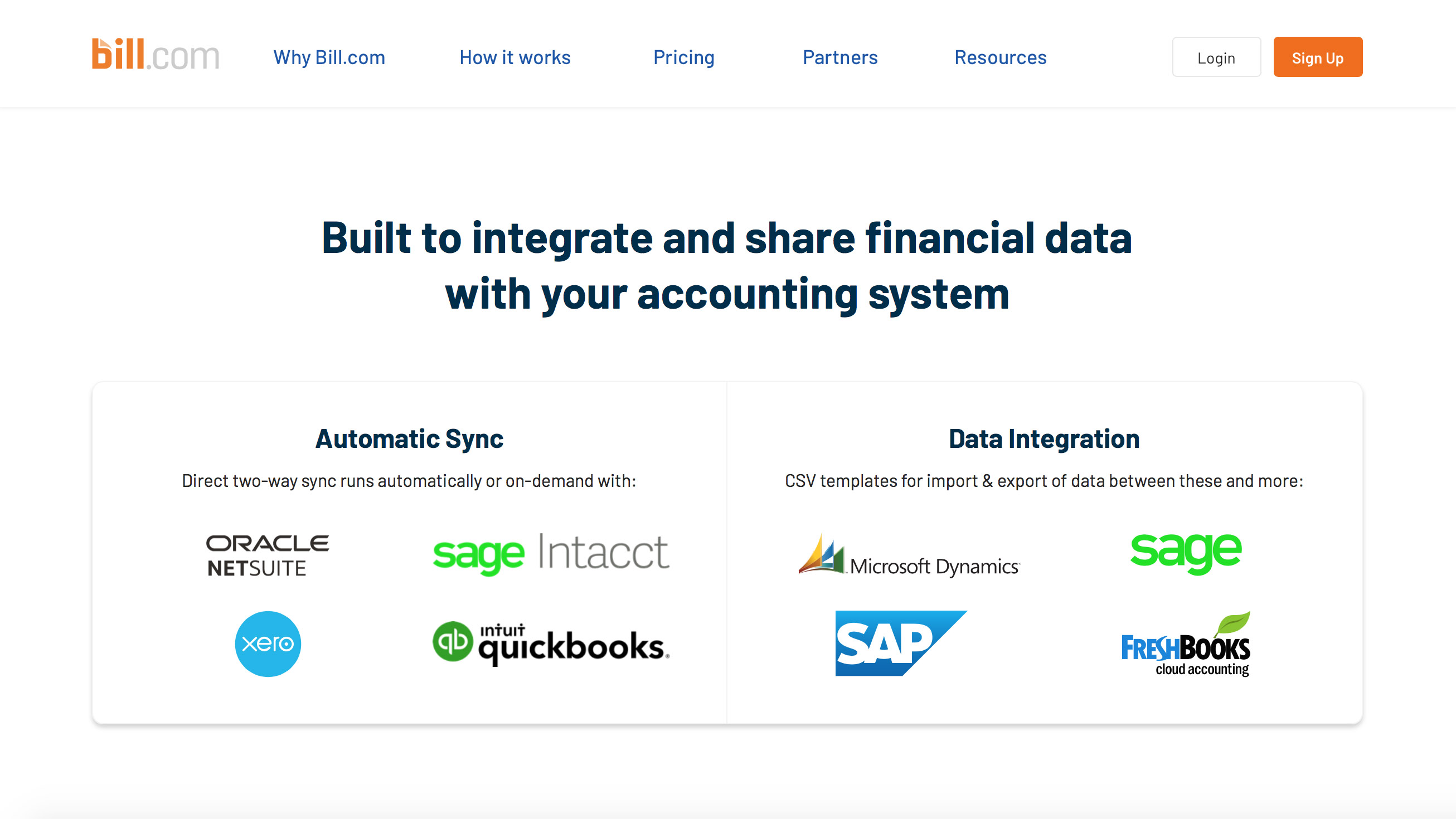

Alongside the high degree of automation that comes with Bill.com business users can also look forward to a decent level of integration. There’s an app area on the Bill.com website that delivers a neat insight into this valuable aspect of the cloud-based software.

Bill.com can be configured to be in tune with Sage Intacct, Intuit’s QuickBooks, Tallie, which specializes in expense reports, Earth Class Mail, which offers postal mail scanned to your Bill.com inbox plus there’s compatibility with Tax1099.com.

Additional integrations include Hubdoc, for bills and statement sharing with your Bill.com account, Oracle’s NetSuite, Expensify’s expense reporting package plus more on the accounting side of things thanks to compatibility with both QuickBooks Online and Xero.

As for the general interface and usability Bill.com is both easy to pick up and keeps stress levels reassuringly low thanks to its logical layout, nicely engineered menu system and overall solid visual appeal.

Support

Like all other cloud-based software systems there is a healthy support structure behind Bill.com, which can cover anything and everything related to the product. In terms of online assistance then there is the Bill.com help hub, and it’s a comprehensive collection of guides to getting started, informative features on how and why specific tools and options work in the system along with detailed overviews on all aspects of your account and how to manage it.

There’s a handy chat-style window that appears if you click on the ‘Contact Us’ button, and that can offer answers to many common queries before you need to make contact with support staff. If you’re a signed-up user of Bill.com then it’s possible to make contact with support staff once you’re logged in, by clicking on the ‘Support’ option in the navigation pane. However, regular users seem to report mixed feelings on the levels of service provided.

Final verdict

Bill.com will be appealing for businesses looking to handle their accounts payable and accounts receivable chores in a more efficient fashion. However, Bill.com also has plenty of appeal for professional accountants, with a side of the software targeted specifically for that marketplace.

While Bill.com comes with an intuitive interface and plenty of powerful features it might also prove to be a little too expensive for smaller businesses. The various options for integrating Bill.com with other packages, such as accounting software such as QuickBooks Online and Xero adds appeal. The downside though is that Bill.com’s invoicing aspect is less impressive than the rest of the features and functions. It’s definitely worthy of a free trial investigation though.

Additional business software options worth looking at include Sage Business Cloud Accounting, QuickBooks, Xero, FreshBooks, Freeagent, GoSimpleTax, TaxCalc, Nomisma, ABC Self-Assessment or Crunch.

- We've also highlighted the best accounting software

from TechRadar - All the latest technology news https://ift.tt/38x7rb4

No comments:

Post a Comment