Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

Identity theft is never that big of a problem for most folks out there, as we happily surf the web, sign up for services with a credit card and use social media. That is, until you become a victim of identity theft and then it becomes somewhere between a major headache and quite a nightmare. You totally feel helpless and lost, trying to rebound from fraudulent use of your bank account or credit card, and trying to recover the lost dollars along with your credit.

Zander Identity Theft Protection puts the focus squarely on protection and alerts against loss, which makes sense since Zander is an insurance company. Unlike most of the other identity theft products out there, such as Norton LifeLock or Complete ID, having the backing of an insurance company does provide some peace of mind if the worst happens, which is a clear benefit.

Unfortunately, Zander Identity Theft Protection goes for the value play, and doesn’t really go the extra mile to provide any unusual or powerful features. For example, the website is extremely thin on details about how the app even works or what it does. You end up feeling a bit like the identity protection is merely a way to generate more interest in its other insurance products (including disability, auto and health), all prominently listed at the top of the Zander Insurance website. You won’t see the extensive list of features, the stellar web design and interface, or the deep identity theft information of competing products, which makes Zander Identity Theft Protection difficult to recommend for anything but basic protection if you need a bargain price.

Plans and pricing

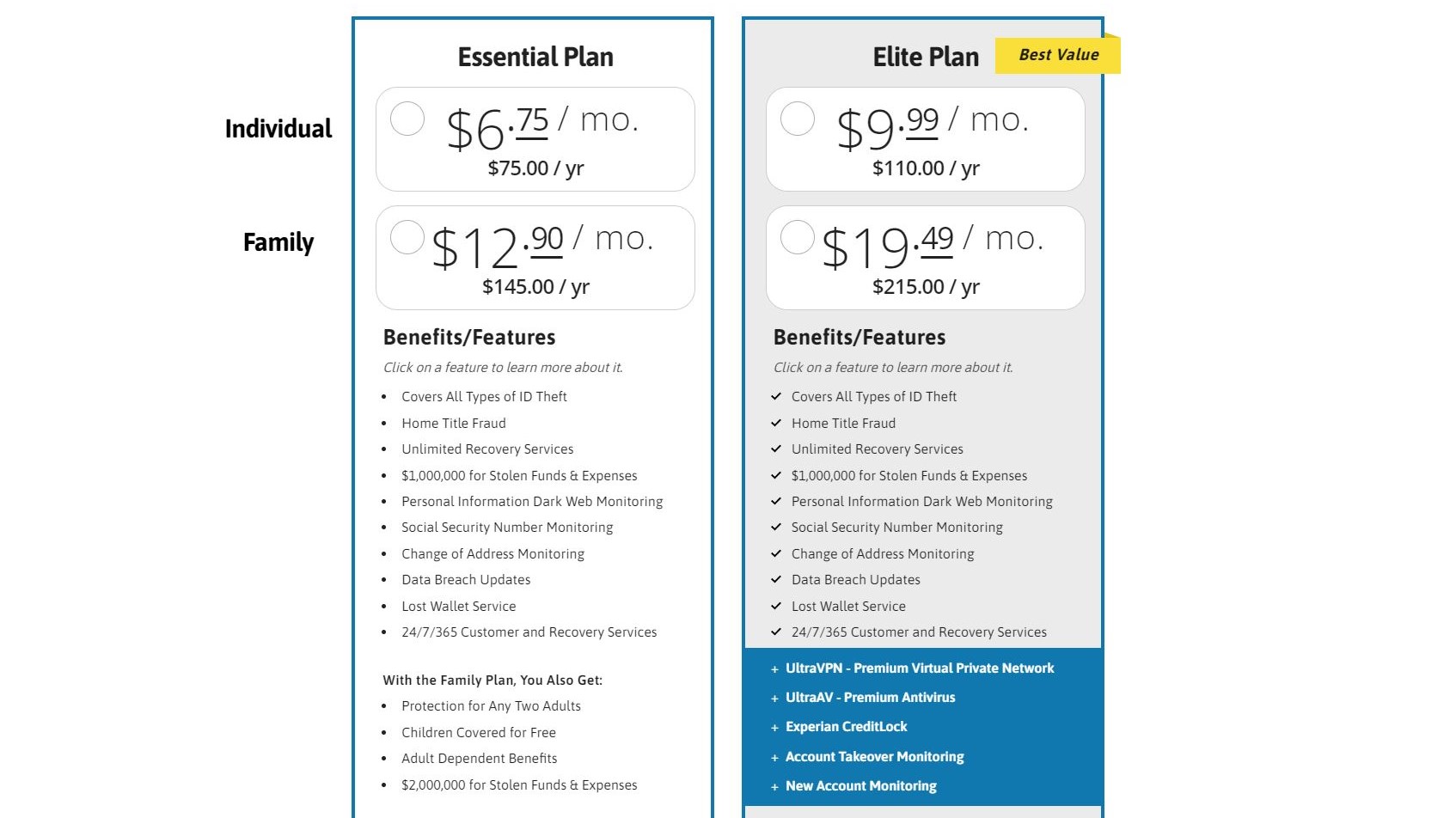

Really, the most compelling feature is the price. The starter plan is $6.75 per month for an individual, and you can rely on an app that provides some basic services like fraud alerts, bank compromise issues, and social security theft. There is even a small savings for those paying annually at $75, which works out to $6.25 monthly. You can call and speak to a customer service rep who will help you resolve problems. There’s nothing that sticks out as unusual, it does at least include Dark Web monitoring, coverage for up to $1,000,000 for Stolen Funds & Expenses, Home Title Fraud and a lost wallet service to quickly assist in cancelling credit cards and replacing what was in the lost wallet or purse.

You can also choose the family plan which costs $12.90 per month. This covers two adults, and an unlimited number of children. It also ups the coverage to up to $2,000,000 in coverage for Stolen Funds & Expenses, up to $1 million for each person on the plan.

There is also a higher tier plan, the Elite Plan. It is still affordable at $9.99/month for an individual, and $19.49/month for a family, with an analogous small discount when paid annually. This plan includes all the coverage of the lower plan, but adds UltraVPN for up to 20 devices (currently $6.99/month when paid month to month although much less expensive with an annual subscription), UltraAV Antivirus, Experian Credit Lock, monitoring for new accounts, and account takeover monitoring. For those that need a VPN and an antivirus, this becomes a nice packaged deal.

Interface

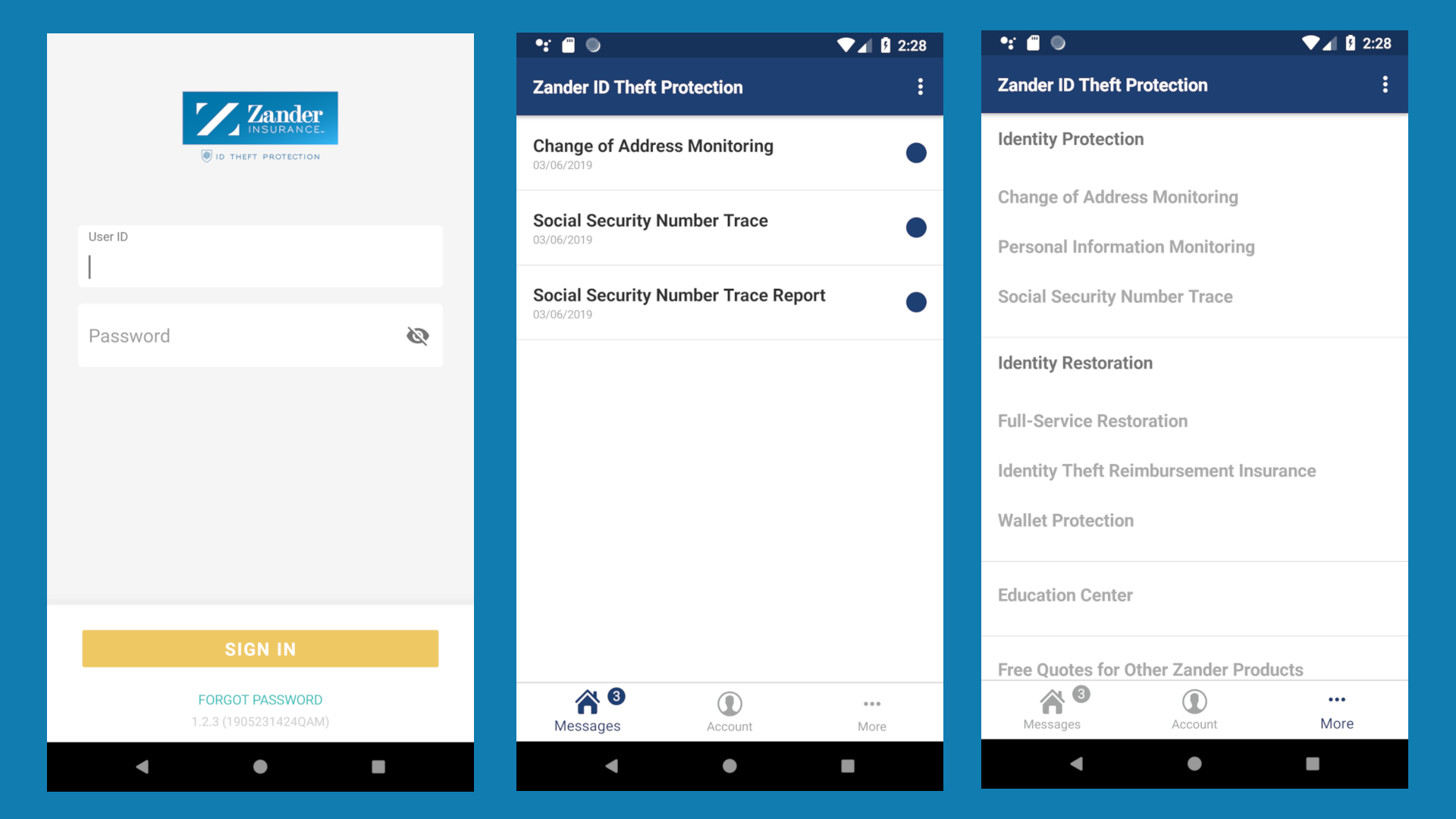

Zander Identity Theft Protection sticks to the basics, with a clean, white interface. The app shows you alerts related to your identity protection, including any problems with a bank account or credit card. You won’t find the professional look of Norton LifeLock, our top pick for interface and design. There aren’t any powerful wizards that explain every last detail with Zander Identity Theft Protection and few status updates that show you how much progress you’ve made in protecting your identity.

Reviews of the iOS smartphone Zander Identity theft app are quite tepid with a 2.7 out of 5 stars rating, with as many 1 star reviews as 5 star reviews. Users complain about difficulty in account creation with the app, that the phone alerts require logging into the website to find what the alert is, and difficulty with cancellation.

Features

The main takeaway with Zander Identity Theft Protection is that the features are all fairly standard. You could argue that you are paying a low price for average features, and maybe that’s just fine. There’s all of the typical fraud alerts and protections you will find with every other app. A hotline number to talk to an agent is also a typical offering for most apps like this, and Zander Insurance lists this feature twice as though that makes it more compelling. (Sadly that seems like a standard practice with identity theft apps that list features twice.)

In terms of theft protection insurance, Zander Identity Theft Protection will repay you up to $1 million for stolen funds and expenses, on the lower tier of plan, which rises to $2 million for the upper plan.

The competition

This is a tale of two factors: Zander Identity Theft Protection is the cheapest identity theft protection we’ve found, but is light on features. Zander Identity Theft Protection even costs less than the lowest price plan we’ve found, and that one requires a Costco membership: Complete ID costs $8.99 per month if you have the Exec plan at Costco, which costs $120 per year.

Zander’s coverage is essentially a way to see fraud alerts and work with customer service to resolve the problems. The app doesn’t compete with the major identity theft companies like Norton, Experian, or Equifax. The closest competitor is Complete ID and that’s only because the prices are similar.

Then again, Zander’s higher tier offering does provide a VPN, and antivirus, and while more money, does make it more attractive for those that want to bundle all of these services together.

Final verdict

In the end, it’s somewhat difficult to recommend the basic Zander Identity Theft Protection because the actual product is fairly limited. While the price is extremely low, especially if you choose the annual plan, you won’t benefit from the extensive backing and rich features of an app like IDNotify, Complete ID, Norton LifeLock, or IdentityForce.

What you do end up with is some basic alerts and protections that might be worth the small investment on a monthly or annual basis. We wish that website was more complete and explained more of the features - there’s really just a small section that lists a few of the alerts and the customer service hotline. The problem is that identity theft is not really something to take lightly. Picking a product only by the low price might be a recipe for disaster.

We've also highlighted the best identity theft protection

from TechRadar - All the latest technology news https://ift.tt/3to79MK

No comments:

Post a Comment